eCONomics Part V: IN THE YEAR 2024 IF MAN IS STILL ALIVE

.. enter the ‘Cuban’ missile crisis, only this time it’s on steroids

With thanks to our own Colin Maxwell of New Zealand.

Please see: Part 1 ; Part 2 ; Part 3 ; Part 4

NB – AN EXPLANATION OF ACRONYMS/TERMS/ETC used in the article are listed at the end of this discussion piece.

1. Introduction

My sincere apologies for this delay in my sequel. I picked up a very nasty bug and at the same time experienced some major computer glitches.

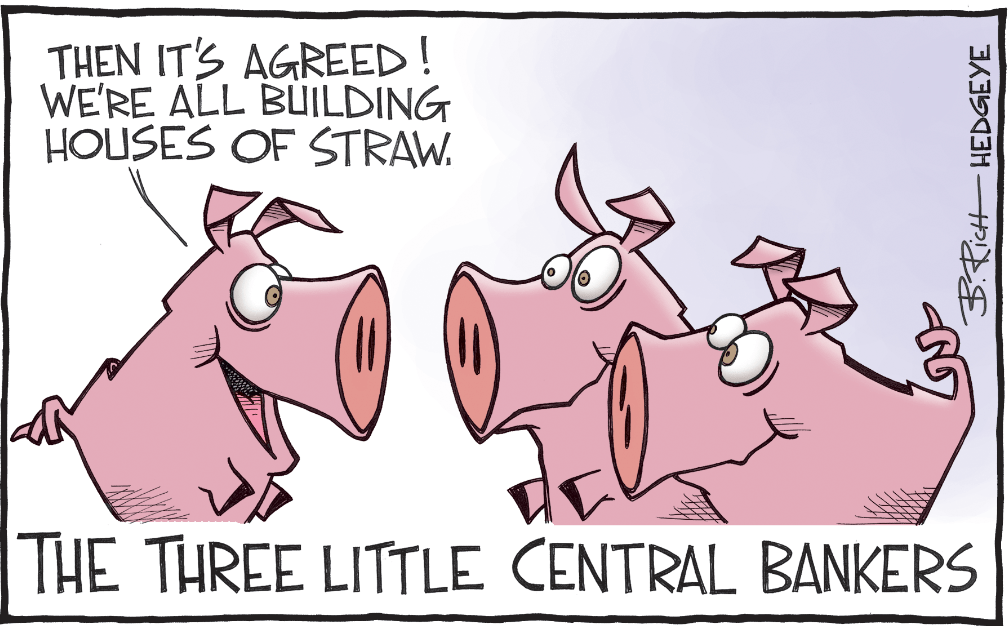

In the mean time it is my grim conclusion that the Western world won’t escape this gigantic financial hole it has dug for itself without going through a major systemic financial meltdown. Only with a tragic event will the critical mass of society actually rise up to demand the massive reform that is required to have any hope of recovering functional and sustainable economies.

I see no political escape from of the U$ train wreck (described earlier in eCONomics Part I) because the various components of the uni-party have almost identical financial and foreign policies. None of the POTUS candidates even bother to address the financial situation, let alone offer up any remotely workable solutions.

So too, history is massively against any hope of a successful independent POTUS, and the fact that RFK Jr is going to take votes from both sides of the ‘aisle’ means that IF the election actually takes place, Trump will be almost certainly be the winner.

This is despite the fact that he is a proven compulsive liar who still brags about his godfather role in the development of the experimental mRNA killer toxins. He also showed his true colours when he backstabbed Assange – whose published revelations paved the way for Trump to beat the truely dreadful and dangerous Hillary Clinton in 2016. What a truly sad commentary when a truly inept braggart like this is the only option available that would avoid a second term by the appalling ‘Crash Test Dummy’.

However, as the old cliche states – “seven days is a long time in politics” – however seven months is practically an eternity – especially given the dire financial situation and the multiple global military flash points.

Also, how soon could the pitchforks and riots manifest in the streets, and subsequently give the Biden camp the excuse they crave to declare Martial Law, in doing so creating the perfect opportunity to further tighten the noose on society’s freedom, by implementing a retail CBDC and it’s associated social credit controls?

The other possible titles I considered were…

KEEP PRINTING OR CRASH – nope, it’s keep printing and crash anyway.

IMMINENT GOLD REVALUATION – a worthy title too, as arguably this is the most significant single factor in a perfect storm of events that will be the end of the reign of the Western hegemon.

2. A Collision Of No Less Than Twelve Events In A Perfect Storm

#1 The Ukraine debacle exposing how utterly demented the U$ and NATOstan are in their hegemonic lust for control of resources, perpetual war and general mayhem. The comprehensive loss of yet another war is bad enough, but their attempts to hide this loss and extend the blood bath, makes NATOstan’s actions even more reprehensible.

#2 The Palestinian debacle – and Israel and the U$’s desire to genocide their population. The U$ and Israel play good cop, bad cop, whilst they carry on deliberate and overt genocide. Both countries have effectively torched the tiny skerrick of diplomatic capital they had left.

Many Palestians are already at level 5 starvation and yet this is being used as a weapon – even using aerial food drops as bait with Israeli troops stationed nearby with machine guns to gun them down as they try to retrieve food for their starving families.

#3 The build up in the tensions in the South China Sea and Warshington’s brazen prediction of a full scale war.

#4 The general weaponisation of the dollar and Western based payment systems.

#5 The idiotic 16,000 sanctions wrought on Russia – a reminder to the entire planet that this strategy doesn’t work – it only succeeds in providing a huge extra helping of bad karma for the voracious Western Hegemon.

#6 An announcement of a revaluation of gold by BRICS+ is imminent – as soon as this happens the Western fiat currencies will begin to implode – this as a corollary, with a return to hard backed currencies, may well turn out to be the single most crippling factor of all.

#7 The stability of the BRICS+ multiple commodity trade-only instrument will be

extremely compelling – not only will it be hard backed by gold, more than likely silver, and a host of other commodities (perhaps, as many as 20), but the smoothing effects of this system will come into effect and give countries the confidence to use it.

#8 The cooperative nature of the member nation’s currencies will encourage their use and an increasing percentage of trade will be done using swaps and bartering of goods for goods.

#9 Gresham’s Law will kick in – countries/people will liquidate their weak money and hold as reserves money which is regarded as strong and stable. This is when the exponential ramp up in hurt for the West will begin.

#10 The fact that it is almost impossible to miss the fact that Uncle $laughter has deliberately set about trying to destroy Europe – this gradual realisation by Mainstreet Europe, as the reality finally bites in, will never be lived down. Kissinger’s prophetic words should ring in the ears of the entire RoW.

#11 The absolutely disgraceful treatment of LatAm and the explicit Monroe Doctrine of raping this entire continent – and no more shocking example of the last century of atrocities than the sellout of the immensely resource rich Argentina by the utterly feckless Milei to Western imperial plutocrats. Refer – General Richardson’s recent visit to Buenos Aires – I just hope that our friend Jorges is travelling OK amongst all of this madness.

Second from left: the new Argentinian President ‘Mad Dog Javier Milei standing next to the archetypical neocon U$ Four Star General Richardson

#12 The highlighting of the centuries of the raping of the African Continent by Western Imperialism – the most recent and habitual protagonist being, you guessed it – Uncle $laughter.

3. Gold Stacking By The Global South

this constitutes the twilight of the fiat currency system

The World Bank reports that central banks bought 1037 tons of gold bullion in 2023, which is only slightly below the all time record set in 2022.

The astute entities, particularly in the ME and Asia are realising that keeping funds in U$ dollars is becoming too much of a liability.

Foreigners who own $14 trillion in stocks in the U$ and a further ~$8 triilion in treasuries are slowly waking up to the fact that they are not even the legal owners of this paper…. see eCONomics Part (I), section (iii) ‘The Great Taking’.

This stacking of bullion is enabled by the U$’s vain obsession of trying to protect the value of its currency. The Global South will continue to stack as the U$ facilitates the suppression of the real price with the COMEX.

It seems incredible, but the MSM has only just managed to figure out that the strength in gold is due to massive central bank buying. Apparently the casino house didn’t see these macro trends either – they were all to far too busy chart-painting and gambling to even look at the underlying fundamentals of why gold and silver were about to break out and head for the hills.

This subject was extensively covered in eCONomics Part (I) and so I won’t regurgitate it here.

Paraphrased from the one and only Alasdair Macleod…

“Money is the back stop of credit, which is why gold is so important. The dollar is not money, it is credit – it relies on the faith we have in the U$ Govt (oh dear!).

This is what is likely to come unstuck, as the entire colossal credit system begins to fall down around our ears.

Insurance has to be money in this event – not BitCoin, but gold. Silver has been demonetised, remaining very much an industrial metal controlled by industrial interests, particularly within China.

However, this control may well be slipping with the Indians buying so much silver, with deliveries on the COMEX this year over 1200 tons. As China loses control of the silver price its monetary characteristics will return.

When credit really does fall apart, people will go for anything tangible – obviously this does not include financial securities – in them there is no protection against inflation because they are in themselves credit which will get swept up in the collapse.”

Into the Maelström

4. Gold, Silver, or Bitcoin — which one(s) will Dah Fed concentrate on manipulating now?

Recently, the ‘cost to borrow’, meaning the cost to short sell GLD shares began to rise sharply from just under 40 BPS (0.4%) by almost 3x to a mind-numbing 1.06%.

Remember too that these borrowed shares ultimately have to be paid back as the price rises further the borrower is left in a ever deepening hole -who on earth would take this risk? – So who is the ‘who’ then? – it has to be dah Fed itself because no TBTF first tier bank compliance team would allow these huge high risk naked short bets to be made.

As the brilliant Andy Maguire recently stated – (paraphrased)…

“Why – because they are attempting to swamp the gold rally by adding borrowed supply in the hope that officials can repay these borrowed supply bets at a lower price. Yes we know that the Fed can print as much as they like, but this is all set to backfire spectacularly.

The Fed is the only remaining CB betting against a higher gold price and they are reduced to deploying the only tool in the tool box, which is using leveraged paper gold to try to chart paint the top of the rally.

Meanwhile, almost every other CB is swapping their excess dollars for physical gold and capitalising on being able to convert the COMEX synthetically driven supply prices into deliverable NSFR compliant bullion through the EFT mechanism. The Fed is now severely limited as to how many CTAs they can suck into puking up their long term bets to repay these GLD shares.”

The Fed is the only remaining global CB (dumb enough) to bet against a higher gold price and to use leveraged paper gold to continue to manipulate the price. Meanwhile any other CB, with half a brain, is swapping their excess dollars for physical gold.

Basically, available gold stocks have contracted ~50% in 4 years and many CTA positions are no longer rinse-able. The ringleaders now appear to be shifting their attention to injecting instability into Bitcoin, and phasing out gold and silver price fixing, as they become more and more badly burnt whilst the organic price discovery process advances.

Clearly, it is far more profitable to play around with cryptos than to have to eventually cough up gold bullion, which is ultimately NSFR compliant, and physically deliverable, leaving them in a deeper and deeper hole.

It is much easier just to print cash to bale themselves out, as their ability to print cash is virtually limitless – as opposed to eventually having to cough up physical gold that they don’t hold anyway.

5. Silver — massive extra demand for silver, notably in India and China.

We now witness an explosion in silver demand for use in the solar industry particularly in India, but it is strong in China too. India’s solar module production demand is likely to grow by ~60% by 2025.

This market requires thousands of extra tons, but the demand is also ramped up even further by the relatively higher price of gold – another perfect storm leading to unprecedented physical demand.

The extra thousands of tons of demand for silver will inevitably force the price much higher during 2024 – this cannot be contained by the bankster’s usual playbook of tricks.

Since the 1930s the gold to silver mining production ratio has stayed remarkably close to 8:1.

The Exeter Pyramid helps us to gain a perspective on how massively undervalued gold and silver bullion is relative to other financial assets and real estate.

When you look at the risk arrows which clearly indicate that there should be movement into gold and silver bullion, at the very least as an insurance hedge, it reveals just how huge the natural impending price discovery process could be.

Ownership of precious metals in the U$ are really only the equivalent of a pimple on an elephants arse – it represents the equivalent of a pitifull 0.5% of their assets.

As Andy Schectman points out – what happens when the population finally flicks up as to the extent of the great taking and if they advance their PM holdings to even a lowly 5%? – that alone would amount to a 10x increase in demand.

This is much like the COMEX debacle where the open interest is 1750% higher than the amount of bars held in their vaults. The dirty word is rehypothecation – meaning that most entities will have no access to physical gold, just as they won’t with silver.

The planned Moscow Metal Exchange could at any time set a relatively modest price for gold at $3000, and silver at say $50-$100. Just like that all of the Western markets could arbitrage straight to the East setting a real price – this would break the COMEX and the London Metal Exchange, and immediately break the dominance and the manipulation by the Western players.

6. Unsustainable Levels of Public Debt – the Destruction of the Middle Class

Daniel Lacalle wrote an excellent piece which was published on ZH April 9, 2024…

“When the fiscal position is unsustainable, the only way for the state to force the acceptance of its debt—newly created currency—is through coercion and repression.

A state’s debt is only an asset when the private sector values its solvency and uses it as a reserve. When the state imposes its insolvency on the economy, its bankruptcy manifests in the destruction of the purchasing power of the currency through inflation and the weakening of real wage purchasing capacity.

The state basically conducts a process of slow default on the economy through rising taxes and weakening the purchasing power of the currency, which leads to weaker growth and erosion of the middle class, the captive hostages of the currency issuer.

Of course, as the currency issuer, the state never acknowledges its imbalances and always blames inflation and weak growth on the private sector, exporters, other nations, and markets. Independent institutions must impose fiscal prudence to prevent a state from destroying the real economy. The state, through the monopoly of currency issuance and the imposition of law and regulation, will always pass on its imbalances to consumers and businesses, thinking it is for their own good.

The government deficit is not creating savings for the private economy. Savings in the real economy accept public debt as an asset when they perceive the currency issuer’s solvency to be reliable. When the government imposes it and disregards the functioning of the productive economy, positioning itself as the source of wealth, it undermines the very foundation it purports to protect: the standard of living for the average citizen.

Governments do not create reserves; their debt becomes a reserve only when the productive private sector economy within their political boundaries thrives and the public finances remain under control.

The state does show its insolvency, like any issuer, in the price of the I.O.U. it distributes, i.e., in the purchasing power of the currency. Public debt is artificial currency creation because the state does not create anything; it only administers the money it collects from the same productive private sector it is choking via taxes and inflation.

The United States debt started to become unsustainable when the Federal Reserve stopped defending the currency and paying attention to monetary aggregates to implement policies designed to disguise the rising cost of indebtedness from unbridled deficit spending.

Artificial currency creation is never neutral. It disproportionately benefits the first recipient of new currency, the government, and massively hurts the last recipients, real wages and deposit savings. It is a massive transfer of wealth from the productive economy and savers to the bureaucratic administration.

More units of public debt mean weaker productive growth, higher taxes, and more inflation in the future. All three are manifestations of a slow burn default.

So, if the state can impose its fiscal imbalances on us, how do we know if the debt it issues is unsustainable?

First, because of the units of GDP created, adding new units of public debt diminishes rapidly.

Second, the erosion of the currency’s purchasing power persists and accelerates.

Third, because productive investment and capital expenditure decline, employment may remain acceptable in the headlines, but real wages, productivity, and the ability of workers to make ends meet deteriorate rapidly.

Today’s narrative tries to tell us that nothing has happened when a lot has. This includes the destruction of the middle class and the deterioration of the small and medium enterprise fabric in favour of a rising bureaucratic administration that consumes higher taxes but still generates more debt and deficits. It does end badly. And all empires end the same way, with the assumption that nothing will happen.

The currency’s acceptance as a reserve does come to an end. The persistent erosion of purchasing power and declining confidence in the legally imposed “lowest risk asset” are some of the red flags some are willing to ignore, maybe because they live off other people’s taxes, or because they benefit from the destruction of the currency through asset inflation. Either way, it is profoundly anti-social and destructive, even if it is a slow detonation.

The fact that there are informed and intelligent investors who willingly ignore the red flags of weakening the middle class, declining purchasing power of the currency and deteriorating solvency and productivity shows why it is so dangerous to allow governments to maintain fiscal imprudence.

The reason why government money creation is so dangerous is because the government is always happy to increase its power over citizens and blame them for the problems its policies create, presenting itself as the solution.”

The CPI – what Rick Rule refers to as the CP LIE – doesn’t include food or fuel which makes it an utterly contrived index. Worse still, it does not even include taxes and yet this is the biggest expense of all – for many it is larger than food, shelter, energy and transportation combined.

Rick notes that for people like himself and the basket of goods he buys, and adding in taxes, it means he is losing around 7% per year on his money.

On a ten year treasury with a coupon value of say 4.1%, which sounds like one hell of a lot better than the 2.0% of days gone by, you are being scammed. If you work out the true rate, it is a disgraceful and debilitating negative 3.9% every year for 10 years compounded on your original investment.

Even the lower echelon within the Fed admit to Rick that the real inflation rate is far higher than what the public is led to believe – this means that there is absolutely no way that they could cut rates, because this would cause even more dramatic loses for depositors and bond holders.

Clearly, the institutional view within the Fed is to not reduce the rate, but within Congress there is a bipartisan desire to reduce rates and particularly within the Biden admin who desperately want to win the next election.

7. BRICS+10 — BRICS+16

onwards and upwards – this subject was discussed extensively back in eCONomics Part (III) of the sequel

Sergei Glazyev’s white paper has received the green light from the Kremlin’s Yuri Ushakov (Putin’s Assistant for Foreign policy) and will be presented to the Kazan summit May 14-19. I will try to do a proper update shortly after we hear the outcome of this important summit.

In the meantime the BRICS+ progress remains relentless, especially given that the BRICS+10 control the lion’s share of the global energy complex – the scale of the de-dollarisation process is poised to reach a completely new level. This is an utterly terrifying and self- inflicted situation that the Western hegemon finds itself in – they dug their own hole and are still digging.

We are now witnessing the creation of an immense socioeconomic-security bloc that will have more than 90% of global wealth and resources to back it up.

8. Don’t Blame COVID for the Looming Meltdown

— in fact the u$ economy was on the rocks well before any of us had even heard of covid – see the implosion of repo market in August 2019 on Trump’s watch.

Suffice to say the repo market that completely imploded on Trump’s watch when none of the banks trusted one another’s collateral any longer – even treasuries were not trusted any longer, as it became known that there could be multiple claims on them too. The repo market never recovered, and now sits at around $2 trillion as reverse repo – obviously the banks don’t want money on the street, and would rather hand it over to the Fed overnight.

Some of the big players see what is coming down the pipeline now too, and they are sucking PMs out of the exchanges.

NB – the U$ dollar is worth only 3 cents now compared to its value when the ‘Creature from Jekyll Island’ was incorporated. The next step is the road to a big fat ZERO cents worth, which is where all fiat ends up sooner or later.

There is also the opportunity for the PBS and FTT models to be deployed in sovereign countries where they can be introduced without hegemonic retribution and intimidation.

Within the BRICS+ block, it will be a case of letting 190 flowers bloom with the sharing of the success stories within so that the models that work in a particular set of circumstances can be embraced by other regions/countries with the confidence of them being already proven working models.

This would be an ongoing organic process that involves continued decentralisation and bottom up governance in a mix of cooperative endeavour that works to develop the real economy and to create permanent wealth for all of society, rather than just permanently feathering the nests of the parasitic financial casino economy.

I’m not going to label the new paradigm with any of the existing ism’s because this will be something completely novel. There should really be only one central maxim necessary – ‘treat others as you would wish to be treated yourself’ – that’s it!

The ongoing transition should be be a gradual orderly and organic evolution as new models prove their worth in the real world leading to a renaissance of the true human spirit.

9. The Hegemon’s Rapidly Deteriorating Financial State

On current trends the Biden Admin looks set to increase the existing debt of $34.5 trillion by $7.3 T to a mind-numbing $41.8 trillion.

If they could foist a retail CBDC on the country, then there are effectively no limits as to how low they can push interest rates. Negative rates could be invoked to eat up principle. Imagine that, when they have already destroyed 97% of the purchasing power of the dollar.

Using the existing commercial banks for the retail account doesn’t make CBDCs any more palatable as they would simply be using the commercial banks to distribute their policy, whilst achieving much the same effect as every man and his dog having a personal bank account at the Fed.

It is impossible for me to imagine any scenario where a retail CBDC is desirable

… but the absolute worst case is if it was administered as a retail account at the central bank in the case of the farcical Fed model, where that entity is 100% owned by a cartel of thieving and parasitic private banksters.

Even in a highly developed and extensive public utility banking system retail CBDCs would be a completely unworkable disaster. They would by definition, completely preclude a highly competitive banking system where a multitude of banks and models all compete with the result being beneficial interest rates and a high standard of customer services for society at large.

Retail CBDCs would be tantamount to the Soviet era Gosbank model where for ~70 years there was only one banking entity in the entire country. The result was as disastrous as it was predictable.

Even more alarming is the fact that the U$ FDIC is essentially trying to guarantee ~$20 trillion of deposits with a fund of a minuscule $121.8 billion – that amounts to a truly farcical 0.5 cents insurance on the dollar.

Even Bloomberg admits the fact that with $929 billion of CRE debt becoming due in the next 9.5 months, this could potentially topple hundreds of U$ banks.

10. BITCOIN — A Trojan Horse? — rolled out in during the Lehman debacle

QE started then – TPTB endeavoured to have everything looking as normal as possible so that the public was oblivious to what was going on.

As a rule people who go for gold, silver, and cryptos have the same wish – ie, to operate outside the main system, but does bitcoin really belong in that category?

Surely bringing in a Bitcoin ETF is rendering it into the casino system anyway. Initially they were very appealing to the libertarian who sees the debasement of fiat and is looking for an alternative – but aren’t crypto currencies technically fiat anyway? This is made even more precarious when there are ~10,000 different crypto currencies.

Perhaps we all need to consider the fact that this might have been a cunning plan to get digital currencies out and about in the public domain and normalised in the minds of society at large.

Who was Satoshi Nakamoto anyway, the so-called author of the original white paper and who devised the first blockchain database? Supposedly the work began in the second quarter of 2007, and the domain name bitcoin.org was registered in August 2008.

He allegedly continued in the development of the software until mid-2010 before handing over control of the source code depository and domains to various entities, ending his recognised personal involvement in the project.

According to Wiki, Nakamoto had some $73 billion worth of Bitcoin in 2021, making him the 15th richest person on the planet.

Given that the Japanese term ‘satoshi’ can mean ‘intelligent’ and ‘nakamoto’, ‘central’ was there a playful suggestion behind the name as to who was really behind the scene – ‘Central Intelligence’? – what a horrible thought.

Is this just another ploy to keep money from going into gold and silver and exposing yet another dying fiat currency.

https://m.youtube.com/watch?v=lBo_mVV81n8

11. mRNA Toxins — Another Extremely Bearish Factor

The massive rate of toxic mRNA jabs deployed in Western counties is an extremely depressing subject, but it would be remiss to not mention this as another giant debacle that will help seal the hegemon’s fate and virtually guarantee a debilitating debt death spiral for much of the West

Ed Dowd’s numbers suggest that globally ~ 2.2 billion people have been either killed or are permanently disabled by the toxic jab roll-out – that’s the same one that Trump still brags about.

97% of the US military were jabbed and their own data shows cancer rates are up ~1000%. Heart disease is up 970% in the US military.

In the UK, 18-39 year olds, jabbed 4 times are 318% more likely to die than their unjabbed contemporary control group.

The German Govt recently admitted that there was no pandemic and that figures demonstrate that the fully jabbed on average surrender 25 years of their life.

In the U$, CDC data revealed that each jab increased mortality by 7%.

▪️ Highly jabbed regions showed ~15% higher mortality than 2021.

▪️ 2 doses and 3 boosted were 35% more likely to die in 2022 than 2021.

▪️ By contrast, the unjabbed were no more likely to die in 2022 than 2021.

This will have a disastrous effect on productivity, as not only is the fully productive work force dramatically depleted, but the care of the seriously jab injured will soak up even more labour resources and other expenses.

12. Wrap Up

Oh, and I just located some good news, albeit though, very much confined to the Global South realm. There is a much lower level of debt in the RoW and developing economies, compared to the ravenous NATOstan – it is completely self evident even within the figures released by that dreadful IMF creature…

2022 IMF DATA – % of debt to GDP

▪️ World 238%

▪️ Advanced’ economies 277%

▪️ Euro Area 254%

▪️ UK 252%

▪️ U$ 273%

▪️ Emerging market economies 191%

▪️ Others 124%

▪️ Low income developing countries 88%

In fact this debt could become almost negligible if the BRICS+ in unison, gave the economic Western hitmen the middle finger salute in all cases where they have made deliberately cynical, unpayable, and predatory loans in the first place.

The new socio-economic paradigm will be premised on cooperative goodwill and mutual progress for all participating countries. In this blueprint a minimum of resources will be spent on killing one another, and member nations will enjoy the security provided by an immense bloc that has more than 90% of global wealth and resources to back it up.

There is also the opportunity for the PBS and FTT models to be deployed in sovereign countries where they can be introduced without retribution from the hegemon – the fiscal and monetary aspects of this model were covered in eCONomics Part II.

Within the block it could be a case of letting 190 flowers bloom with the sharing of the success stories within the group, so that the models that work in a particular set of circumstances can be embraced by other regions/countries with the confidence of them being already proven working models.

This would be an ongoing organic process that involves continued decentralisation and bottom up governance in a mix of cooperative endeavour that works to develop the real economy in order to create permanent wealth for all of society – rather than just permanently feathering the nests of the shadowy figures ensconced behind the parasitic financial casino economy.

I’m not going to label the new paradigm with any of the existing ism’s because it will be something completely novel. There should be only one central maxim necessary – ‘treat others as you would wish to be treated yourself’ – that’s it!

Fingers and toes all crossed, the ongoing transition should be be a gradual orderly and organic evolution, as new models prove their worth in the real world in a monumental transition and a complete renaissance of the very essence of the true human spirit.

And how prophetic were the words of the great Leonard Cohen (my all time favourite Canadian, my friend Emerson) in his epic song ‘Anthem’ which took him some 10 years to complete.

Verse 5 nails what is happening right now, as a torrent of countries clamour join the BRICS+ juggernaut…

You can add up the parts

You won’t have the sum

You can strike up the march

There is no drum

Every heart

Every heart to love will come

But like a refugee

Such a tragedy that this great man passed and never got to see this massive event beginning to unfold.

— strap on a good quality headset, crank up the volume, and accompany Cohen on an incredible journey.

Colin Maxwell – April 11, 2024

EXPLANATION OF ACRONYMS/TERMS/JARGON used in the article…

AKA = Also Known As

CB = Central Bank

CTA = Commodity Trade Advisor

COMEX = The Commodity Exchange Inc. = the world’s leading derivatives marketplace for trading metals – formed 50 years ago specifically to rig gold and silver prices, to try to protect Western fiat currencies

CPI = Consumer Price Index

CTA = Commodity Trade Advisor

ETF = Exchange Traded Funds

EFP = Exchange of Futures for Physical

Global South = all countries apart from NATOstan = AKA RoW

GLD = the SPDR EFT gold share Nasdaq ticker/symbol

NSFR = Net Stable Funding Ratio

NATO = North Atlantic ‘Terror’ Organisation

NATOstan = NATO plus its yapping lapdogs and sundry hangers on – sadly this group includes both NZ and Australia

Repo = Repurchase Agreement – a form of short term (often overnight) form of borrowing for dealers in government securities

Reverse Repos = the reverse of a Repo – it is the party originally buying the security

Rinse-able = this term refers to investors that can be lured out of their long positions

RoW = Rest of the World

SPDR = one of the family of ETFs managed by State Street, the TBTF largest asset manager on the planet with around $44 trillion in assets under management, custody and administration – it tracks the price of gold bullion in the over-the counter market – the SPDR gold share ETF is known as GLD

TPTB = The Powers That Be

Related Posts

-

Pulling USUK like Building 7

April 28, 2024 -

Thank You China!

April 26, 2024 -

A Bridge too Far

April 3, 2024 -

The World sees the Outlaw US Empire

March 29, 2024 -

Submitting ZOG & UNSC

March 28, 2024 -

West’s Geoeconomic Gamble behind Gaza Genocide

March 27, 2024 -

Will BRICS launch a new world in 2024?

March 15, 2024 -

Nuland’s Policy Has Collapsed

March 14, 2024 -

Engineered Destruction of America and Europe

March 13, 2024 -

eCONomics Part IV: Interest Rates Manipulation

March 12, 2024

The reality of the collapsing Ponzi is bitter! Fruits of the Con since 1910 -1913 Jekyll Island. And I am one of those huffing and puffing on the flames to speed the damage to get through the horror. Astounding. A world-changing event on its own to match the battlefields of… Read more »

Thanks very much for giving this piece some air, AHH. My estimation is that there is only a tiny percentage of people here in New Sheepland who are the slightest bit interested in any of these observations. When the crash comes they will be all ears then – too late!… Read more »

Excellent thesis, thank you, as always. The question, as with all fiscal matters, is one of timing: when does all this happen? For myself, with most forecasting nowadays, both monetary and geopolitical, I take the “skyfall” scenario and divide by 4. This allows my racing heart to still 😉 And… Read more »

Thank you so much, Grieved – and yes, I agree, I am sure the BRICS+ are in no great hurry, and yet at the same time remain utterly incredulous that the West remains full steam ahead, straight towards the iceberg field and with no one even anywhere near the tiller.… Read more »

this is the wonder of being on the cutting edge! We entered the Event Horizon, a new experience for all. I second Grieved’s appreciation for your immense value. Thanks for your courage. And that is the gift of courage and writing or teaching — the teacher is the first to… Read more »

thank you, dear colin, this tour de force is the bell that still can ring. bless you for the gift of leonard. kayaking the maelstrom alongside leonard soothes seasick nausea. bitcoin as a trojan horse, wow! brics+ has been patient & are playing its stones as though each stone black… Read more »

My pleasure Emerson – I find I am driven to write more and more regularly – yes, in order to learn myself, but also to avoid falling into a downhill spiral of depressive anxiety and feelings of hopelessness. Yes, regarding bitcoin – my jury is still out, and this trojan… Read more »

Back sometime in the late ’70s, early ’80s not sure exactly when I read in some book, probably Doug Casey, of the author’s program to fix the inflation crisis. Whoever it was would have IIRC done several rounds of cuts of 25%, including the military. I doubt it was Gary… Read more »

PS Unfortunately, no longer have those books — chucked long before they could be useful now that those wolves named Inflation and Depression (or Collapse) really are threatening the village.

All good Wlhaught – I have followed Casey on and off for many years, but his call on Argentina and Milei certainly rocked me. I believe that that country squandered an incredible opportunity in turning down their invitation to join BRICS+, and basically insulting and ostracised their two main trading… Read more »

I love your powerful Zeppelin imagery, Emerson – tragically, I think that’s precisely where the West is headed.

dear colin, 🙏🏿 please, continue to guide our circling the maelstrom of our world’s historic axis turning. we are blessed to have you & dear AHH focussing & directing the cameras. 🕊️

bless you both. 🙏🏿

TBTF = To Big to Fail

Thanks, Wlhaught – I missed that one.

Regards

Col

Jeffrey Tucker is just as suspicious as I am that the hegemon’s financial situation is far worse than most of us would even dare to imagine. https://www.zerohedge.com/economics/its-official-reflation-here ‘For months and even years, the mainstream news has sought to spin terrible inflation news. It’s not so bad, it’s just transitional, it’s… Read more »

What about John Williams Shadowstats? He had inflation running near 10% from sometime around Shrub’s last term (IIRC) (Note: did not (earlier) see charts by Colin posted roughly the same time) until the senile sock puppet when official figures jumped from 1.8% to 6.8% and his went up to around… Read more »

Must have had a page that was at least 12 minutes stale, but note energy consumption comment at end.

All above noted – thanks Wlhaught.

Cheers

Col

Also courtesy of ShadowStats.com – we are all being led up the garden path – the loss of purchasing power of the dollar is horrendous. If these numbers were properly disclosed it would show that interest yield/interest received on bank deposits and treasuries are massively negative. Da Fed has no… Read more »

Further to my foray into the cryptocurrency realm in which I have very limited technical expertise – preferring to follow my gut instincts – perhaps the most glaring and sinister shortcoming of Bitcoin is the scalability aspect – I can most certainly wrap my head around this aspect. It is… Read more »

thank you, dear colin. you are a treasure & we are blessed to have your guidance. 🙏🏿

Hmmm – what the hell would I know anyway – according to Joe Consorti, Bitcoin’s monetary properties are the Holy Grail of the fiat financial world!

https://www.zerohedge.com/news/2024-04-15/bitcoin-trading-stocks-informational-arbitrage-century

As one commenter said – ” I love the smell of black tulips in the morning”

Perhaps the old rock relic, AKA gold, is the best indicator of just how much Japan’s (¥) Yen purchasing power is in trouble. The ¥’s value looks dismal enough against all the other dirty shirts in the laundry basket, but when you view it in the context of the gold… Read more »

The dismal CEIC figures that include unfunded liabilities in total debt…

FROM AN EXCELLENT WSOP ARTICLE – April 17 2024 THE FINANCIAL CHICANERY CONTINUES – NOTHING HAS BEEN LEARNT SINCE 2008, other than a bag of extra tricks designed to hide an impending financial trainwreck that will, IMO be far worse than 1929. https://wallstreetonparade.com/2024/04/gold-has-set-historic-highs-this-year-as-the-federal-reserve-has-reported-historic-losses/ SUMMARISED/PARAPHRASED… For the first time since 1916,… Read more »

MORE STORM CLOUDS GATHERING

wow! a few questions, dear colin…please, knowing i know nothing, indulge a few stupid questions: 1) i thought the fed did not have to report…anything? i did not think they were under regulation as a reserve bank. if that is true how is it that a loss can be determined?… Read more »

This is just my understanding Emerson. My sequel is really only a series of articles to hopefully promote discussion on these topics and to try to help Mainstreet, including myself, understand how and why the Western casino is disappearing down the gurgler – talk about the fox looking after the… Read more »

dear colin, thank you! reports weekly?! wow, am i ever relieved there are people like you & alasdair macleod reading these reports, b/c the ‘we cheat we lie we steal’ gang wrote the book on how to cook & obfuscate numbers. hopefully after i’ve read through the links (multiple times)… Read more »

#2 Re “First reported loss” – I think this is partly just coincidence Emerson – they couldn’t really hide the loss anyway – and there was already a tidal wave of geopolitical events building up – besides, most of these clowns still thought Russia could be beaten anyway. #3 “Yellen’s… Read more »

Thanks Colin for this excellent summary. When you look at it in bullet point form its just astounding that the western monetary system is still working at all. We must be so very close to the end of it. And yes Bitcoin has always seemed suspicious to me as well.… Read more »

You make some excellent points here K – the more heads trying to get to the bottom of this the better! I think Bitcoin undoudtedly had multifaceted aims much like 9/11, Covid, and so many of these evil projects that the plutocrats concoct. The most tragic aspect in all of… Read more »

Some painstaking work by Peter Hanseler – he comes to a very similar conclusion that I came to in my journey…

https://www.zerohedge.com/geopolitical/brics-project-century

dear colin, thank you for your posts, links & guidance. i trust you know how deeply you are appreciated & how fortunate we are to have you share your years of research & indispensable views with us? if not, thank you, dear colin, for sharing your wisdom & expertise, i,… Read more »

Thank you, Emerson! Hopefully, this new idea will work OK with a pinned main article/sequel every 2 weeks or so, and then backed up by interactive commentary in between to try to keep current and informed with some of the key events. There is just so damn much happening financially… Read more »

BLOOMBERG’S OUTRAGEOUS SPIN ON JAMIE DIMON AND SERIAL FELON BANK JPMC – some of the most hypocritical tripe and barefaced lies I have ever encountered. Interviewer Emily Chang… He is widely seen as the rock in the storms of 21st-century finance, and even at times a kind of guardian of… Read more »

“We are trying to figure out how to make society better, and I do consider that as part of my job.” He may be telling the truth! Involves a lot less of us, with the survivors abject mind-controlled slaves. Too bad RICs and 90% Hunanity will nuke him first rather… Read more »

JPMC was also the 2nd most voracious borrower in the Repo crisis in October 2019 when that market effectively ceased to exist. The banks no longer trusted one another’s collateral and as such the emergency repo market effectively became reverse repo provided by the Fed from then on. The biggest… Read more »

dear col, your updates are gold in such tinny days, thank you. 🦋

“gold in tinny days”…Hah!

WHAT IS GOING ON – even dah Fed is talking about “Runnables of $21.3 Trillion”! And where would we be without the courageous Pam and Russ Martens down at WSOP (Wall Street On Parade). https://wallstreetonparade.com/2024/04/the-fed-tallies-up-a-big-threat-to-financial-stability-in-the-u-s-runnables-at-21-3-trillion/ … quoted… To our way of thinking, “runnable” is not a good word to be… Read more »

In my reading this morning I noticed this article on ZH, note the typo in the heading, in which Paul Donovan, Chief Economist at UBS laments Jerome Powell’s “lack of economic training”. https://www.zerohedge.com/news/2024-04-24/chief-economist-does-powell-even-have-gamplan How on earth does he come to that conclusion – for crying out loud, the Fed employs… Read more »

I NORMALLY LOATH FINANCIAL GRAPHS – BUT NOT THIS ONE! Indeed this one is worth far more than 1000 words, perhaps even 5000. This explains to me the biggest global financial paradigm change, at least since 1971, if not 1913. The white line tracks foreign holdings of treasuries against the… Read more »